Homeowners Insurance in and around Rochester

Protect what's important from catastrophe.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Rochester

- Byron

- Stewartville

- Austin

- Kasson

- Pine Island

- St. Paul

- Minneapolis

- Owatonna

- Oronoco

- Zumbrota

There’s No Place Like Home

One of the most important actions you can take for your loved ones is to cover your home through State Farm. This way you can slow down knowing that your home is taken care of.

Protect what's important from catastrophe.

The key to great homeowners insurance.

Protect Your Home With Insurance From State Farm

David Jorgenson will help you feel right at home by getting you set up with secure insurance that fits your needs. State Farm's coverage for your home not only covers the structure of your home, but can also protect valuable items like your pictures.

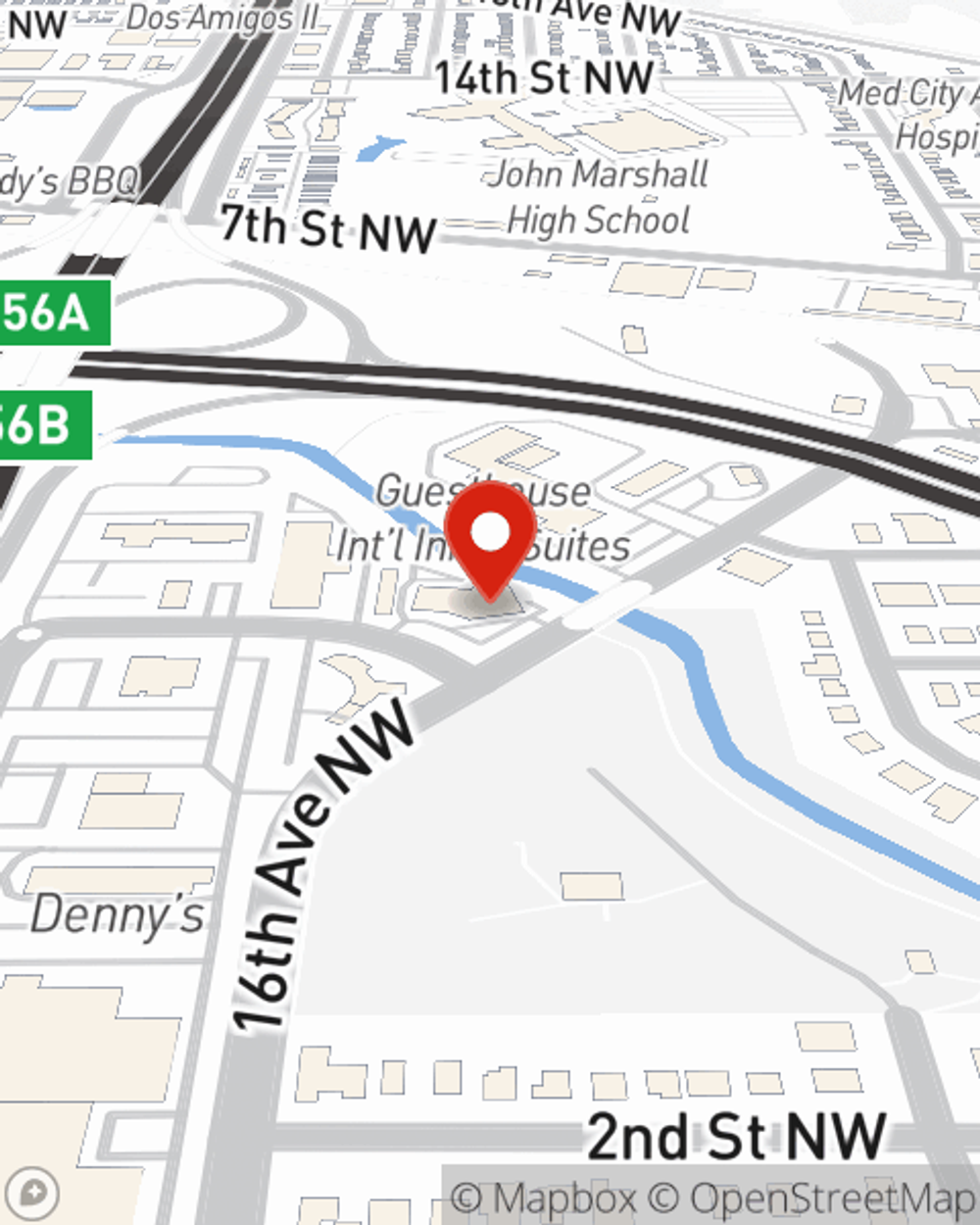

When your Rochester, MN, house is insured by State Farm, even if the worst comes to pass, your home may be covered! Call or go online today and see how State Farm agent David Jorgenson can help you protect your home.

Have More Questions About Homeowners Insurance?

Call David at (507) 216-5274 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

What to know about fire-resistant homes

What to know about fire-resistant homes

Simple maintenance, proper material choice and leading practices can help make the outside of your home more fire resistant.

David Jorgenson

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

What to know about fire-resistant homes

What to know about fire-resistant homes

Simple maintenance, proper material choice and leading practices can help make the outside of your home more fire resistant.